Get In-Depth Audits FAST with Our 30 Days Express Audit Services

Our professional audit services go above and beyond, providing comprehensive and actionable audit reports that allow you to gain in-depth insight into your company’s financial statements.

At AG, we go above and beyond to ensure that your financial audit is comprehensive, detailed, and actionable.

With our extensive auditing services, your business will be completely compliant with the laws and regulations of the Accounting and Corporate Regulatory Authority (ACRA). Plus, you will have a comprehensive understanding of your business’s financial health and potential growth trajectory. So, take the first step towards complete financial transparency and security by engaging our auditing firm.

Say goodbye to hidden discrepancies and unforeseen financial surprises

How would you like to be able to have a transparent view of your business’s inner operations and internal control? Seeking high-quality audit services that leaves no stone unturned and no error untouched?

Running a business is a high-stakes endeavour. One undetected error or oversight can lead to costly consequences, diminishing your hard-earned profits and reputational integrity.

Here’s the truth: The solidity of your audit can either be your strongest defence or your weakest link. So, why not choose a trusted and experienced audit firm in Singapore that works for you, not against you?

Welcome to your solution – AG is one of the top mid-tier audit firms in Singapore, specialising in serving both local SMEs and multinational corporations.

Why Choose Us as Your Audit Firm in Singapore

Expedited Audit Process: 30 Days KPI

Tailored Solutions, Tangible Results

Seasoned Pros at Your Service

Quick & Attentive Customer Service

One-Stop-Shop for All Your Corporate Advisory Needs

The Audit Services We Provide in Singapore

How AG Prevents Audit Delay

with IR Global Network members in 155+ jurisdictions worldwide

AG Audit Services Meet Your Group Audit Needs

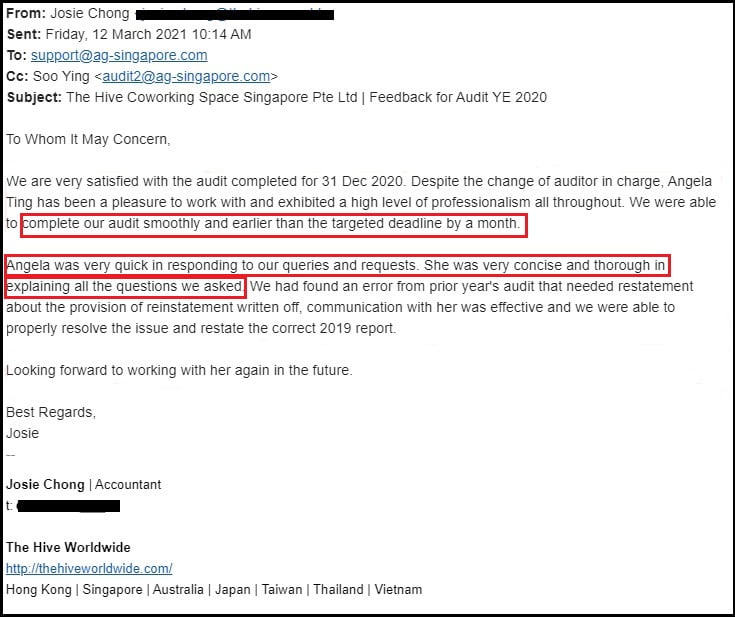

”Completed audit smoothly earlier than the targeted deadline by 1 month.”

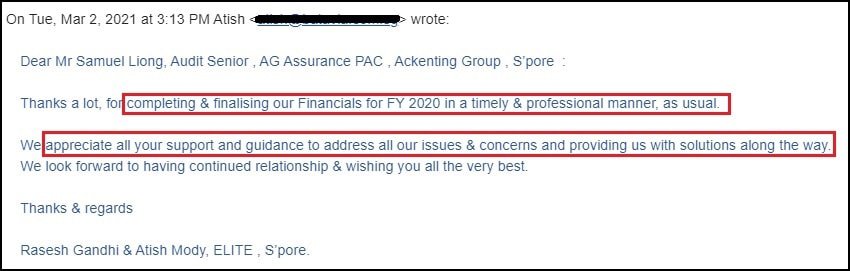

”Completed and finalised audit in a timely and professional manner as usual.”

How We Hit Our 30 Days KPI for Your Full Audit Report

The AG Audit Process

- Meet with our team of senior auditors and audit managersso we better understand your business model.

- Create a customised audit checklist based on your business needsas we do not believe in a one-size-fits-all solution.

- Run through the checklist with youso that you are well-prepared for a satisfying audit report in advance.

- Analyse your business, find weaknesses and suggest solutionsin 2-4 weeks, 50% faster than the industry standard of 4-8 weeks.

- Audit time schedule will also be constantly reviewed and approved by youto ensure your audits are finalised promptly before your deadlines, reducing cost, process and time.

Successful Audit Case Study

Our Audit Team

Our audit team is made up of 20+ audit professionals ready to serve you.

Audit Service Fee

| Starting from | |

| Statutory audit services (active company) | S$3,000 |

| Sales audit services | S$800 |

| Other special audit services | Varies (ask for a quote) |

What is the audit timeframe for completing statutory audit services?

Not Sure Where to Start?

If you’re uncertain about initiating the auditing process, consulting with AG is your first step towards clarity and compliance. Our team of seasoned auditors, with experience across various industries, will provide bespoke services, ensuring your financial practices meet the highest standards of accuracy and integrity.

Frequently Asked Questions About Auditing Services in Singapore

FAST. EFFECTIVE. PROVEN.

Here’s what our clients have said about us

OCBC Prestige Partner

to get your accounts Audited and Trusted by Banks