Get In-Depth Audits FAST with Our 30 Days Accelerated Audit Services

Ackenting Group (AG) is a leading mid-tier audit firm in Singapore, leveraging proprietary AI-driven integration to deliver high-precision statutory and specialized audits. Designed for Singapore’s most ambitious enterprises, every engagement is powered by our 30-Day Completion Protocol—delivering elite financial credibility with unparalleled efficiency.

The AG Advantage:

- AI-Enhanced Precision: We move beyond manual sampling. Our tech-forward approach automates complex data verification, eliminating human error while uncovering deeper financial insights for your leadership team.

- The 30-Day Protocol: Eliminate the stress of “last-minute” filings. Our disciplined, high-speed methodology is engineered to meet rigorous ACRA and IRAS deadlines without ever compromising on audit quality.

- ACRA-Certified Authority: Led by senior Public Accountants and Certified Auditors, we ensure every report adheres strictly to the latest SFRS and SSA regulatory standards.

- Proven Institutional Trust: With over 2,000 successful audit engagements across Singapore’s diverse industrial landscape, we provide the stability of a large firm with the agility of a boutique partner.

Audit Filing Requirements

Under the Companies Act, all private limited companies in Singapore are required to comply with statutory audit requirements under local regulations. However, the exact audit obligations depend on the size, revenue, and structure of the business.

All companies, including small and non-listed companies, must file annual returns (AR) with ACRA. Non-listed companies have up to seven months after the end of their financial year to submit their AR. If an AGM is held, the AR must be filed within one month after the AGM. If an AGM is not required, the AR must still be submitted no later than 7 months after the financial year-end.

When submitting financial statements, most companies must file them in XBRL format. However, Exempt Private Companies (EPCs) and dormant companies may qualify for simplified filing requirements or declaration-based submissions, instead of submitting full XBRL financial statements.

But not all companies are required to undergo a statutory audit. Companies that qualify as a small company may be exempt from audit if they meet at least two of the following conditions for two consecutive financial years:

While an audit may not be mandatory, it remains important for companies to prepare financial statements in compliance with Singapore Financial Reporting Standards and to maintain proper accounting records. This helps ensure accurate reporting, supports regulatory compliance, and provides greater transparency into the company’s financial position.

To ensure a smooth audit process, companies are required to maintain accurate and up-to-date documentation. Commonly required documents include:

Timely completion of audit filing obligations helps businesses avoid regulatory issues, maintain good standing with authorities, and build credibility with banks, investors, and stakeholders. Regular compliance also ensures that financial records remain accurate, transparent, and suitable for future growth or funding requirements.

What types of audit services does AG Singapore provide?

Statutory Audit

Internal & External Audit

Sales Audit

Grant Audit

Group Consolidation & Amalgamation Audit

BCA Audit

MCST Audit

Charities Audit

Lucky Draw Audit

Get Your Accounts Audited by

OCBC Prestige Partner

Nothing is better than having your accounts trusted by banks

How long does a statutory audit take for a Singapore SME?

By integrating AI-driven insights into our 30-Day Accelerated Protocol, AG Singapore delivers statutory audits with unmatched efficiency, ensuring completion within 30 days of receiving your documentation.

With a proven track record of 2,000+ engagements, we provide the transparency and strategic foresight only a seasoned, tech-forward firm can offer. T&Cs apply.

Searching for an audit firm that actually prioritizes your reporting deadlines?

100 Clients. 30 Days. Zero Delays.

Unlike over-leveraged competitors that stretch their teams thin, we strictly limit our annual intake to 100 clients. This exclusivity ensures the resources necessary to maintain our signature 30-Day Accelerated Audit Protocol. Eliminate the risk of late-filing penalties with a fast-track audit service engineered for strict compliance deadlines.

How much are audit service fees in Singapore?

Audit Certainty Starts with Price Certainty. We eliminate the ‘billable hour’ anxiety. AG operates on a Fixed-Fee Model, providing a transparent, all-in quote from day one. We believe your audit should be a fixed investment, not a fluctuating expense.

-

Fixed-Fee: Your statutory audit costs are locked in upfront for total budget certainty.

-

Approval-First Protocol: We never bill for out-of-scope items without your prior authorization. If an issue arises, we present the solution and get your sign-off before proceeding.

-

Zero Hidden Fees: No hidden disbursements or administrative surcharges.

Our commitment is simple: Transparent communication, proactive adjustments, and a final invoice that is never a surprise.

| Audit Service Type | Starting Fee (SGD) | Best For |

| Statutory Audit | S$5,000 | Annual ACRA Compliance |

| Sales (GTO) Audit | S$800 | Shopping Mall Tenants |

| Grant audit | Quote Required | EDG / PSG Grant Claims |

| Other special audit | Quote Required | Management’s use |

How We Hit Our 30 Days KPI for Your Full Audit Report

AG Audit Process

- Meet with our team of senior auditors and audit managersso we better understand your business model.

- Create a customised audit checklist based on your business needsas we do not believe in a one-size-fits-all solution.

- Run through the checklist with youso that you are well-prepared for a satisfying audit report in advance.

- Analyse your business, find weaknesses and suggest solutionsin 2-4 weeks, 50% faster than the industry standard of 4-8 weeks.

- Audit time schedule will also be constantly reviewed and approved by youto ensure your audits are finalised promptly before your deadlines, reducing cost, process and time.

Benefits of Local Audit Services

Gain a competitive edge through our company’s audit services in Singapore:

Accelerated Audit Process: 30 Days KPI

No more waiting months

to get your financial statements audited

AG Audit Team

Our audit team is made up of 20+ audit professionals ready to serve you.

Note from the Managing Partner

“In my career, I’ve led over 2,000 audit engagements, and I’ve learned one painful truth: a late audit is more than a line item—it’s a hit to your professional reputation and a massive weight on your shoulders.

I’m tired of seeing that happen.

That’s why we’ve completely redesigned our firm’s DNA. We implemented a strict 30-day KPI to give you back your certainty. But speed requires focus, which is why we deliberately cap our new client intake at 100 per year.

We turn away business so that we never have to turn away from your deadline. If you’re looking for a partner who values your reputation as much as their own, you’ve found us.”

Successful Audit Case Study

AG Audit Services

Meet Your Group Audit Needs

Backed by IR Global Network Members in 155+ Jurisdictions

93% of clients picked our auditing services

because we met their audit deadlines within 30 days

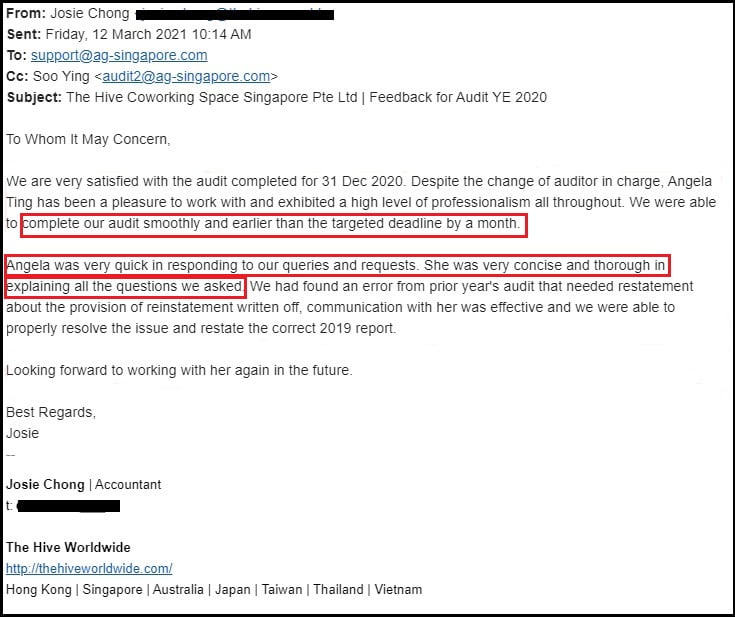

”Completed audit smoothly earlier than the targeted deadline by 1 month.”

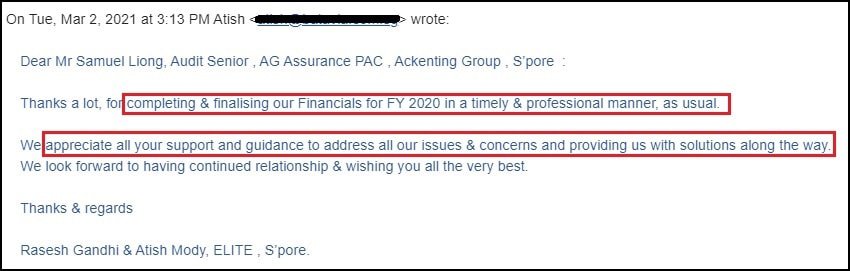

”Completed and finalised audit in a timely and professional manner as usual.”